Industralisation in Singapore in the 1970s

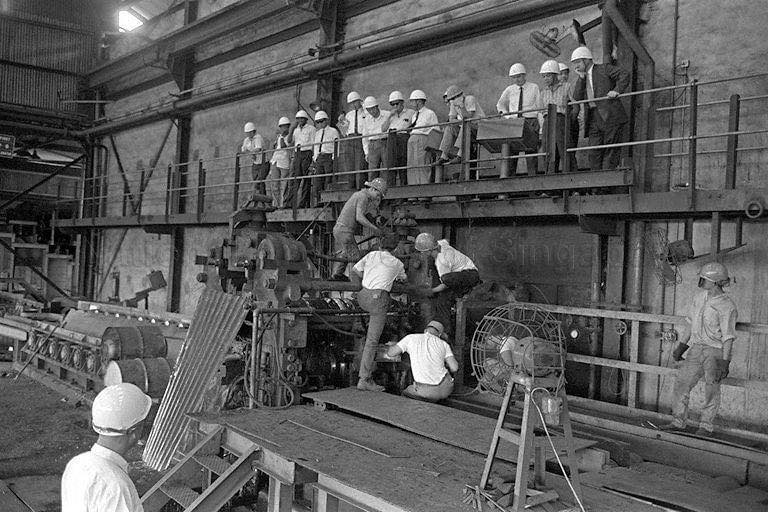

📸: Members of a Polish trade mission visiting the Jurong Industrial Estate, May 1966; Ministry of Information and the Arts Collection, courtesy of National Archives of Singapore

📸: Members of a Polish trade mission visiting the Jurong Industrial Estate, May 1966; Ministry of Information and the Arts Collection, courtesy of National Archives of Singapore

When Singapore separated from Malaysia in 1965, we suddenly lost over 10 million consumers in a common market. Unemployment at that time was close to 9% — even before the British announced a withdrawal of troops from Singapore, which would leave thousands more without a job. How to grow our economy when we have no hinterland or natural resources?

#ChallengeAccepted We industrialised, and we tapped into the global market. With an export-oriented strategy, we opened our borders to foreign investors and large multinational companies that could invest in Singapore’s infrastructure and transfer knowledge to local companies.

As then Finance Minister Goh Keng Swee said in an essay published in 1976, “Singapore’s growing industries produced goods not for the domestic market, which was far too small, nor even for the regional market in Southeast Asia… Our market was the world markets. They brought with them not only production and management know-how, but also the world market for their products.”

To attract foreign investors, the government created a conducive investment environment by building facilities, reforming labour laws to promote industrial peace, investing in education with emphasis on relevant skills, and implementing sound monetary policies for stability. Over the years, we have not stopped improving our infrastructures, including our seaport and airports. And we continue to train and upgrade our workforce, and attract top international talents.

As PM Lee said at the National Day Rally this year, “The international tensions and uncertainties make our task harder but countries will still do business with one another; MNCs will still look for places to invest; the world will still need financial centres, and communication and transportation hubs. If we are nimble and enterprising, we will get our share of these and more.”