1986 to 1996: Rebounding into a Decade of Growth

1986 to 1996: Rebounding into a Decade of Growth

The 1985 recession was a painful but important reminder that Singapore could not afford to stand still. Moreover, the growth we saw prior to the recession had started to flag due to resource constraints and diminishing returns on investment.

Change was necessary. But could Singapore restructure the economy in order to capture new opportunities, and stay ahead of the competition from other fast-industrialising economies, including Malaysia, South Korea and Taiwan?

We took on new directions and created different engines of growth. For one, Singapore diversified our economy by developing multiple areas of growth. We also expanded our presence overseas. These efforts fortified our economy’s resilience and created buffers to withstand future downturns.

We took on the challenge and emerged stronger than before.

Growing the Financial Sector

By the 1980s, one area that had become increasingly important to Singapore was the financial sector. In the late 1960s, the development of the Asian Dollar Market helped establish Singapore as a leading foreign exchange market after London New York and Tokyo.

Moreover, while local banks such as OCBC, UOB and OUB have been mainstays in our economy, they primarily supported Chinese merchants and traders before 1965. However, once Singapore began industralisation, these banks became full commercial banks that financed a wider range of activities.

So by the 1980s, financial services had become one of the biggest drivers of Singapore’s economic growth. In 1983, for instance, the financial sector alone accounted for about 30% of overall GDP growth.

Throughout the 1980s and 90s, Singapore also intensified its efforts to develop fee-based financial activities such as fund management, stock trading activities, and insurance.

Growing the Tourism Sector

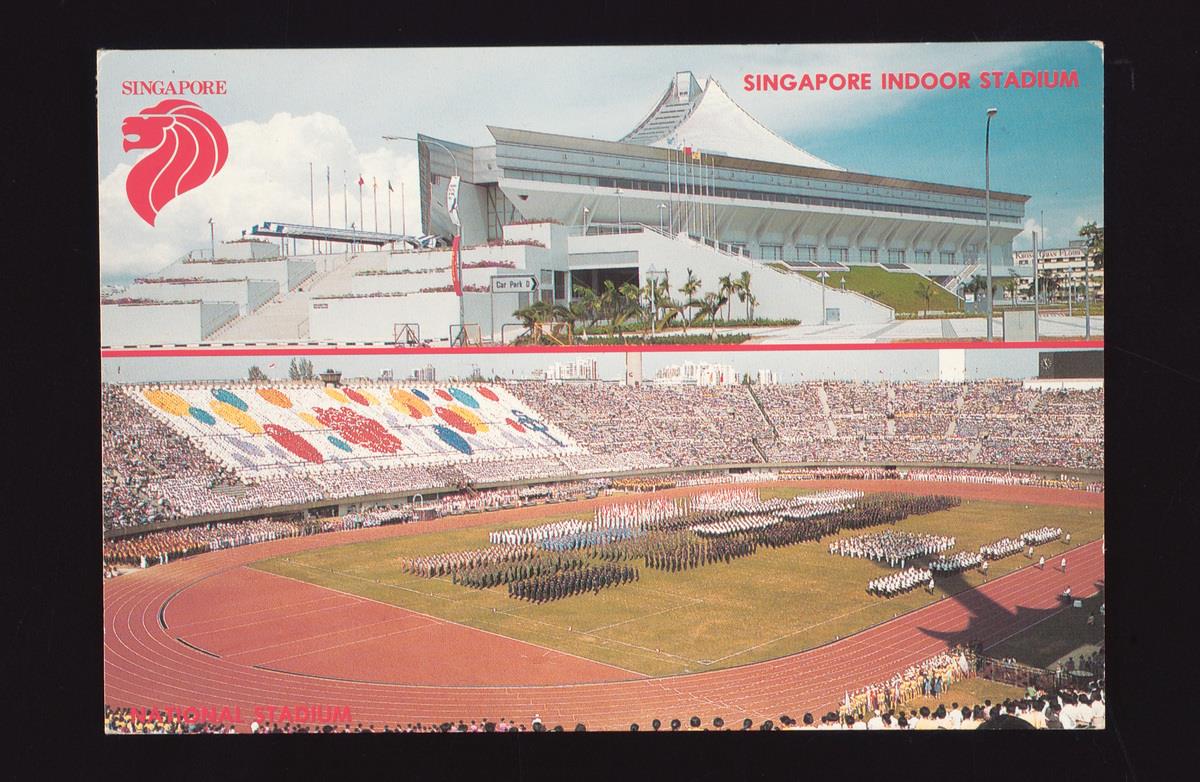

(Image: Indoor Stadium and National Stadium in the early 1990s; Roots.sg)

(Image: Indoor Stadium and National Stadium in the early 1990s; Roots.sg)

In 1981, the government identified the tourism industry as one of the pillars of growth in its 10-year economic development plan. In 1984, a tourism task force headed by then Minister of State for Trade and Industry Wong Kwei Cheong was convened to look at revitalising and promoting Singapore as a major tourist destination.

The task force recommended developing new tourism attractions, such as a new indoor stadium that could host concerts and conventions. It also called for the conservation of historical and cultural areas such as Chinatown.

From then, tourism became one of Singapore’s key drivers of economic growth.

Strengthening the Manufacturing Sector

Throughout the 1980s, the government also continued the the effort to upgrade our industries and help Singapore move up the value chain.

For instance, we deepened our expertise in high-value manufacturing including production, testing and assembly.

We also built on Singapore’s expertise in electronics and precision engineering. This helped Singapore benefit greatly from the growth of personal computing. In fact, from 1986 to 1996, Singapore produced about 45-50% of the world’s hard disks.

Moreover, to ensure that we did not become over-reliant on electronics, we also diversified within the manufacturing sector.

For one, the government embarked on an ambitious plan to develop a petrochemicals facility that would entrench Singapore as a global petrochemicals hub. Jurong Island is a man-made island that combined the best of Singapore – forward thinking, a dare-to-do-and-dream attitude, and an ability to deliver on our word.

Developing an External Wing

(Image: Suzhou Industrial Park; Surbana Jurong)

(Image: Suzhou Industrial Park; Surbana Jurong)

Up till the 1990s, Singapore’s focus had been on bringing in foreign investment, and not on outward investments from Singapore.

However, the 1986 Economic Committee Report noted that investment returns within the country started to face diminishing returns, and moving investments overseas to growing economies would bring in better returns.

This report also suggested that Singapore could export services instead of just goods. For instance, Singapore could draw on our experience in urban planning, and building and operating airports and sea ports to help other industrialising countries develop.

There was also a need to groom local companies that would base their operations in Singapore, while scaling and expanding to overseas markets.

These considerations led the government to embark on a concerted push to develop an external wing of its economy.

Hence, throughout the 1990s, Singapore’s government and our firms made investments across the region from China to Malaysia to Indonesia. In China, we started our first government-to-government project, the Suzhou Industrial Park, and later Tianjin Eco-City. In Indonesia, Singapore companies helped to set up Batamindo Industrial Park and the Bintan Industrial Estate.

(Image: Public Service Division)

(Image: Public Service Division)

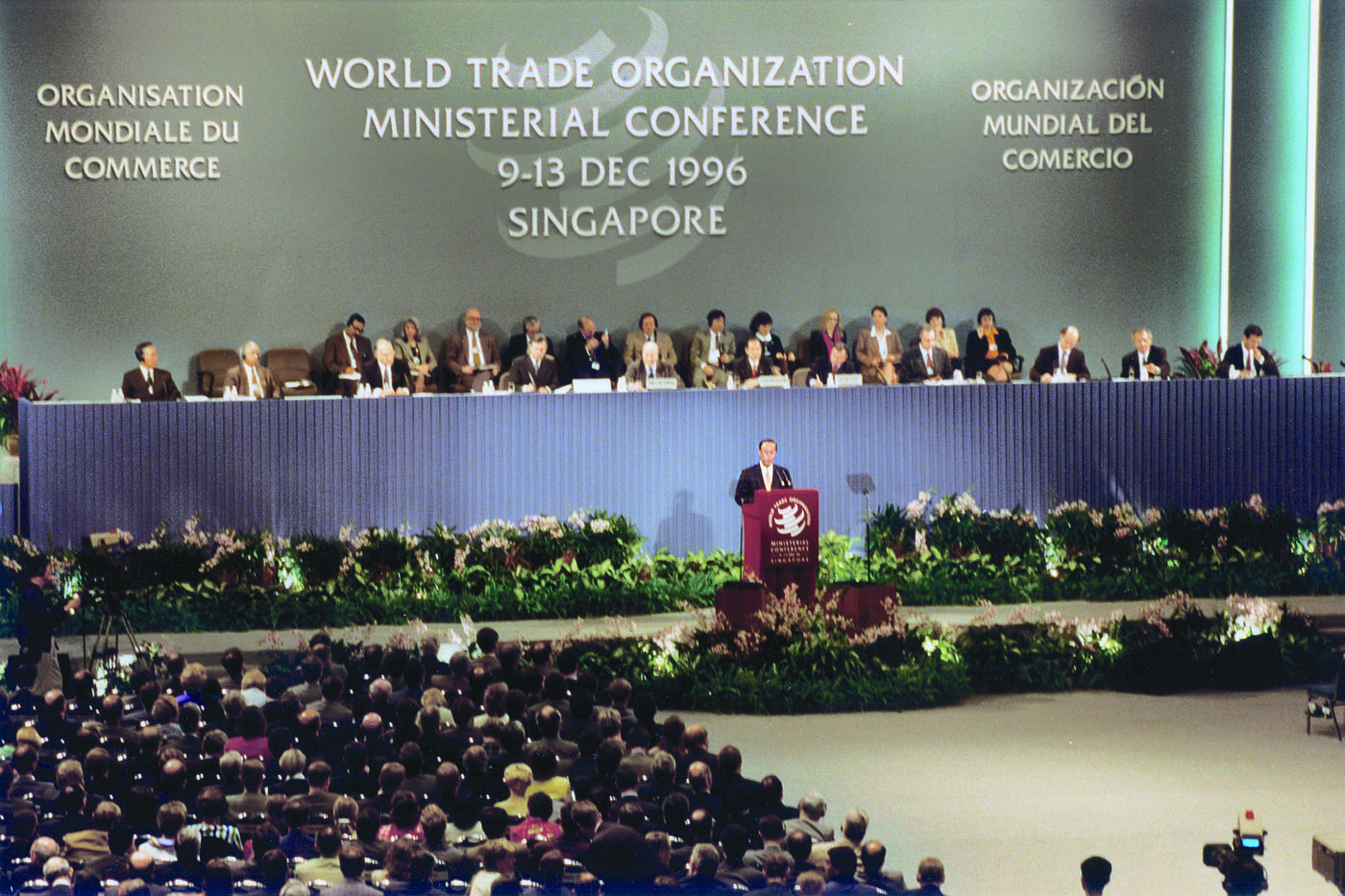

Free Trade Agreements (FTAs)

In order for Singapore to continue exporting goods and services, we had to rely on free trade flows and markets.

Singapore has always supported an open, rules-based multilateral system that promotes a stable and predictable international trading environment such as the World Trade Organisation (WTO).

We also worked to develop a network of FTAs, beginning with the ASEAN Free Trade Area, which was signed in 1992. FTAs are treaties which make trade and investment between 2 or more economies easier.

Singapore has numerous bilateral and multilateral FTAs, which aim to “expand Singapore’s economic space”, as then-Ambassador-at-large Tommy Koh said in 2019.

He also said that “the strategy was to link our small economy to the economies of other bigger countries […] [so] Singapore will be more deeply connected to the global supply chain and our exporters will have lower tariff or non-tariff barriers.”

These FTAs enable Singapore’s exporters, which include foreign manufacturers based here, to enjoy preferential rates in key export markets such as China, Japan and the US. This gives Singapore an edge over other lower-cost locations and is another reason foreign MNCs are keen to invest in Singapore.

Between 1986 and 1996, Singapore grew at an average of 12.8% a year, launching Singapore into a group of fast-growing nations that analysts termed Asian Tigers. Singapore alongside Taiwan, Korea and Hong Kong, were hailed for their remarkable growth over the decade.

One key success factor was the ability to constantly make Singapore relevant to the global economy. Without a large domestic market or natural resources, there is no real impetus for large companies to invest in us. Neither would large countries want to trade with a tiny island that had little to offer in return. However, we continued to reinvent ourselves, refining and reshaping our value proposition.